Sometimes life surprises us in the most unexpected ways. A recent real-life story proves that when destiny gives, it can do so beyond imagination. This is the remarkable journey of an unknown individual who stumbled upon a hidden treasure while simply cleaning his house.

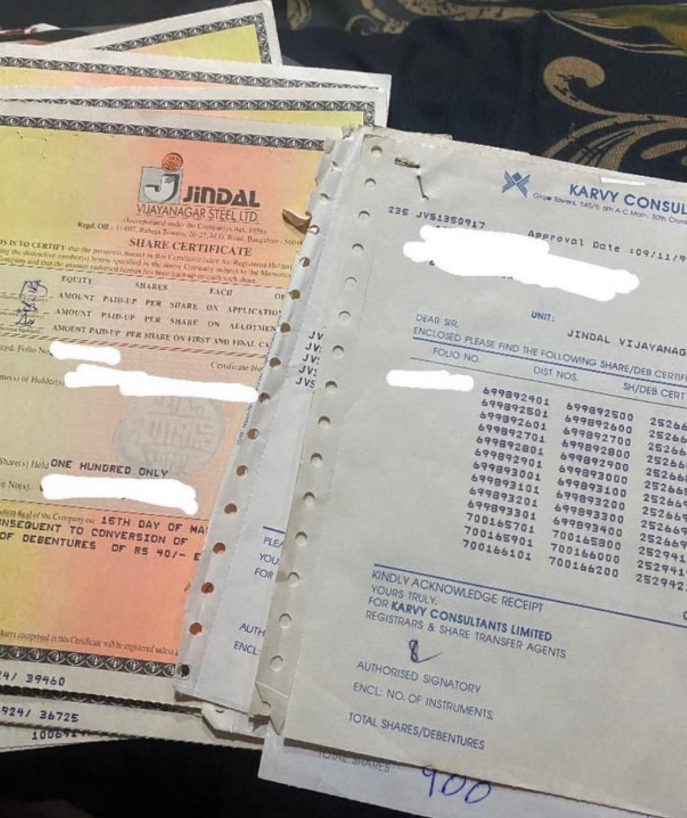

While going through old papers, this person discovered decades-old documents that initially seemed worthless. On closer inspection, they turned out to be physical share certificates — bought more than 35 years ago. What appeared to be a stack of junk turned out to be investment gold.

Back in the 1990s, the person’s father had invested ₹1 lakh to purchase 5,000 shares of Jindal Vijaynagar Steel Limited. Over the years, these share certificates were forgotten and left untouched in a corner of the house. It was only during this recent cleanup that their real worth was discovered.

Upon investigating, it was found that these old shares now belonged to JSW Steel, one of India’s leading steel companies. The current market value of these shares has skyrocketed to over ₹80 crore.

You might wonder how an investment of ₹1 lakh grew to ₹80 crore. The answer lies in corporate actions like mergers and stock splits. In 2005, Jindal Vijaynagar Steel merged with JSW Steel Limited. The merger ratio was 1:16 — for every 1 share of Jindal, 16 shares of JSW were issued. This transformed the original 5,000 shares into 80,000 JSW Steel shares.

Later in 2017, JSW Steel executed a 1:10 stock split, multiplying the 80,000 shares into 8 lakh shares. Today, with JSW Steel’s share price hovering around ₹1,000, the total value of those 8 lakh shares stands at a staggering ₹80 crore.

The story doesn’t end there. In addition to the massive rise in share value, the individual has also benefited from dividends issued over the years. For example, in 2022, JSW Steel paid a dividend of ₹17.30 per share. With 8 lakh shares, the dividend amount comes to approximately ₹1.38 crore for that year alone.

Taking into account all dividends received since 1995, the total dividend income could be as high as ₹5 crore. This means that the combined value of shares and dividends stands at around ₹85 crore.

This incredible discovery first gained attention after a photo of the original share certificate started circulating on social media platform X (formerly Twitter). The identity of the person remains unknown, but the story has gone viral and sparked a wave of curiosity and amazement online.

Some users commented on the tax implications, joking about the 30% tax on such a fortune, while others reminisced about the 1990 IPO of Jindal Vijaynagar Steel, speculating that the investment might have been made then.

This incredible story is a testament to the power of long-term investing and the hidden potential of forgotten assets. It also underlines how corporate actions like mergers, splits, and dividends can significantly alter the value of an investment.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Investment in stocks is subject to market risks. Past performance is not indicative of future results. Please consult a financial advisor before making any investment decisions.