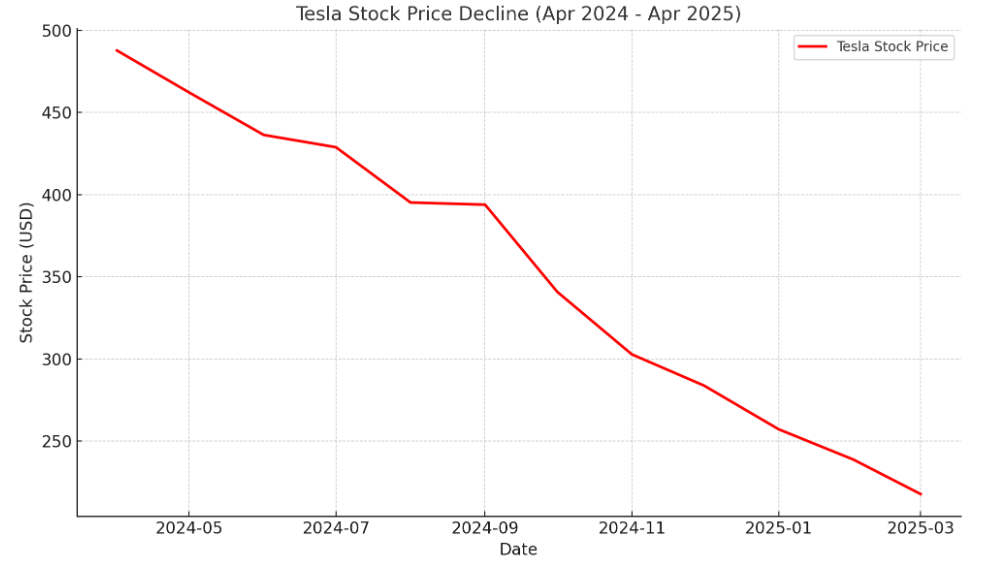

Tesla, the global face of electric vehicles (EVs), once dazzled investors with extraordinary returns. Between April and December 2024, Tesla’s stock rallied nearly 250%, rewarding its investors handsomely. However, as quickly as the stock soared, it began its steep descent. By April 2025, the stock had crashed almost 50% from its December highs, with the price falling from around $488 to a recent low of $214 within the same week.

Surprisingly, this sharp decline isn’t simply the result of global market corrections, as many would assume. A close look at the NASDAQ index shows that the broader tech market only began to fall in March 2025, whereas Tesla had already shed about 37% of its value by that point. Clearly, something much deeper is affecting Tesla.

A large part of the issue lies in Tesla’s sales performance, especially in Europe, which has long been a crucial market for electric vehicles. European consumers, known for their enthusiasm for EVs, are now turning away from Tesla. The sales numbers are alarming: Tesla’s deliveries in Germany have fallen by 62%, France by more than 40%, Belgium by 58%, the Netherlands by 50%, Sweden by 55%, Denmark by 56%, and even EV-loving Finland has seen sharp declines. The UK was the sole exception, recording a modest 6% increase in sales. These figures speak for themselves — when sales drop this hard, revenue follows, and so does the stock price.

But the story doesn’t stop at sales figures. Tesla has also become the target of protests, especially in Europe. This growing anti-Tesla sentiment is now so widespread that the protest movement has even been documented on Wikipedia under the title "Tesla Take Down." The protest, which began in February 2015, is still ongoing and has gained new energy in recent months, partly fueled by Elon Musk’s visible political alliances.

One major trigger for public outrage was Elon Musk’s decision to openly support Donald Trump. Musk donated millions to Trump’s election campaign and personally endorsed him, even appearing in public to show his backing. While Trump has now successfully returned to the White House, this move didn’t sit well with a large section of Tesla’s customer base, especially in Europe, where people began staging protests outside Tesla showrooms and damaging parked Tesla vehicles. This shift in perception has played a significant role in the company’s declining popularity.

Interestingly, many people still believe Elon Musk founded Tesla. In reality, the company was started by Martin Eberhard and Marc Tarpenning, and Musk joined later as an investor. Despite holding only about 12.8% equity in Tesla, Musk remains the face of the company. This once worked as Tesla’s biggest strength, but it seems to have become a liability as Musk’s personal reputation takes a hit.

While Tesla faces turbulence, Chinese EV manufacturer BYD (Build Your Dreams) has been rising steadily, both in terms of sales and stock price. BYD has addressed one of the biggest concerns for EV buyers: long charging times. BYD’s latest battery technology can give an electric car a range of up to 400 km after just five minutes of charging — a feature that no Tesla model currently offers. Besides technological innovation, BYD also wins on aesthetics and pricing. In many comparisons, BYD’s cars are often seen as more stylish, and more importantly, significantly cheaper than Tesla’s.

While an average Tesla starts at around $42,000 for basic rear-wheel drive models and can go up to $80,000 for premium models like the Cybertruck, BYD offers electric hatchbacks at a much more affordable starting price, giving it an edge in emerging and price-sensitive markets.

The market has taken note of this shift. Tesla’s market capitalization, which once peaked at $1.57 trillion, has now fallen to $790 billion — wiping out nearly $780 billion in market value. On the other hand, BYD’s market cap has grown to $165 billion, which is larger than the combined value of India’s top auto manufacturers: Maruti Suzuki ($42.5 billion), Mahindra & Mahindra ($40 billion), and Tata Motors ($32.8 billion). Clearly, BYD is moving at an impressive pace and is becoming a major competitor not just to Tesla but to the global automotive industry at large.

Elon Musk’s apparent shift in focus away from Tesla has also become a concern for investors. In several of his latest podcast appearances, Musk hasn’t discussed Tesla’s future or vision, leaving many to wonder whether his commitment to the company is fading. In the highly competitive EV world, where companies like BYD are continuously launching innovative products, a lack of clear direction from Tesla’s leadership only adds to investor anxiety.

In conclusion, Tesla’s stock price crash is the result of a combination of factors: declining sales, public backlash against Elon Musk, aggressive competition from BYD, and the absence of a strong forward-looking strategy from its CEO. As the EV market evolves, Tesla faces the real challenge of regaining its lost ground — both on the stock chart and in the hearts of consumers.

Disclaimer:

This article is for educational and informational purposes only. It is not financial advice or a recommendation to buy or sell any stock. Stock market investments are subject to market risks, and you should always conduct your own research or consult with a financial advisor before making investment decisions.