Zomato has announced its financial results for the first quarter of FY26, revealing a mixed performance. While profitability took a sharp hit compared to the same period last year, the company's robust revenue growth and investor optimism around its quick commerce segment helped its shares surge nearly 7% to ₹275 on Monday.

For the quarter ended June 30, 2025, Zomato reported a net profit of ₹25 crore, a steep decline from ₹253 crore in the same quarter last year. This marks a significant 90% drop in bottom-line performance on a year-on-year basis.

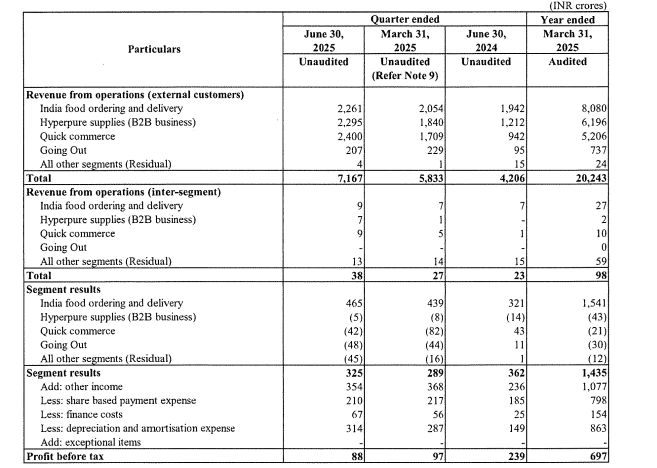

Despite the profit drop, the company's revenue from operations soared to ₹7,167 crore, up by an impressive 70.4% compared to ₹4,206 crore in Q1FY25. This surge was driven primarily by strong growth across all its business verticals, especially in the quick commerce segment.

Zomato’s quick commerce revenue more than doubled year-on-year, rising to ₹2,400 crore in Q1FY26 from ₹942 crore in Q1FY25. The company continues to bet big on this vertical, which includes 10-minute delivery and grocery services. It is now the largest contributor to overall revenue.

The food delivery business also showed steady growth, with revenue from the India food ordering and delivery segment rising to ₹2,261 crore from ₹1,942 crore a year ago. Meanwhile, revenue from Hyperpure, Zomato’s B2B supplies business, increased to ₹2,295 crore from ₹1,826 crore last year.

However, operating performance was under pressure. EBITDA for the quarter fell 35% to ₹115 crore from ₹177 crore in the year-ago period. Consequently, EBITDA margins declined sharply to 1.6% from 4.2% in Q1FY25. Rising delivery and advertising expenses, along with higher employee benefit costs, contributed to the margin contraction.

Segment-wise, the company’s food delivery business remained profitable with a segment result of ₹465 crore, while the quick commerce vertical posted a segment loss of ₹42 crore, indicating ongoing investments in scale and logistics.

In terms of total income, Zomato recorded ₹7,521 crore, including ₹354 crore from other income. Total expenses increased significantly to ₹7,433 crore, with key cost drivers being purchases in trade (₹2,557 crore), delivery-related charges (₹1,690 crore), employee costs (₹830 crore), and advertising (₹671 crore).

After accounting for tax expenses of ₹63 crore, Zomato’s profit after tax stood at ₹25 crore. Yet, the total comprehensive income for the quarter came in at ₹98 crore, compared to ₹266 crore in Q1FY25.

Despite the sharp dip in net profit and operating margin, the stock witnessed a 7% rally during the day, closing at ₹275. This investor confidence is being attributed to the company’s consistent topline growth and strong performance in the quick commerce segment, which many view as the next big growth engine for Zomato.