Central Depository Services (India) Limited (CDSL), Asia’s only listed depository, released its financial results for the quarter ended June 30, 2025. Managing demat services for over 15.86 crore investors, CDSL remains a crucial part of India’s capital markets infrastructure.

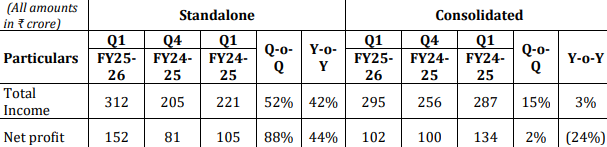

In Q1FY26, the company delivered strong financial and operational performance, particularly on a standalone basis. Standalone total income surged to ₹312 crore, up 52% from ₹205 crore in Q4FY25 and 42% higher than ₹221 crore in Q1FY25. Standalone net profit jumped to ₹152 crore, reflecting an 88% quarter-on-quarter and 44% year-on-year rise.

However, on a consolidated basis, the numbers present a more nuanced picture. Total consolidated income rose to ₹295 crore in Q1FY26, up 15% QoQ and 3% YoY. But consolidated net profit came in at ₹102 crore, slightly higher than ₹100 crore in Q4FY25 but down 24% from ₹134 crore in Q1FY25.

The year-on-year drop in consolidated profit can be largely attributed to the slowdown in the stock market. Unlike last year, when the markets were in a bullish phase and the Nifty was hitting new highs—especially peaking in September 2024—the current financial year has started on a weaker note. Since that peak, the market has been gradually declining, impacting trading activity. When markets fall, many retail investors tend to pull out or reduce their activity, which directly affects CDSL’s transaction volumes and revenue streams.

The lower investor engagement compared to last year’s bull run has had a clear impact on the company’s profit numbers. In contrast, the quarter-on-quarter improvement is supported by the market’s recent rebound over the last two months, which led to higher buying and selling activity. This surge in trading positively impacts CDSL’s business as it generates more transaction-based income.

Despite these cyclical challenges, CDSL achieved key operational milestones. It became the first Indian depository to surpass 15.86 crore demat accounts as of June 30, 2025. Over 56 lakh new demat accounts were opened during Q1FY26, showcasing growing retail investor participation even in a somewhat volatile market environment.

CDSL also continued to receive recognition for its innovation and leadership in financial infrastructure. In May 2025, it received the 'Innovation in Market Infrastructure' award at the Leaders in Custody Asia Awards by Global Custodian. In June 2025, Mr. Girish Amesaara, Chief Financial Officer of CDSL, was honored with the FE CFO Award in the Small Enterprises Segment under the Services sector.

In summary, while the YoY decline in consolidated profit reflects broader market conditions and investor sentiment, the QoQ growth signals a potential recovery supported by improved market activity. CDSL’s expanding user base and consistent recognition reaffirm its central role in India's financial markets.