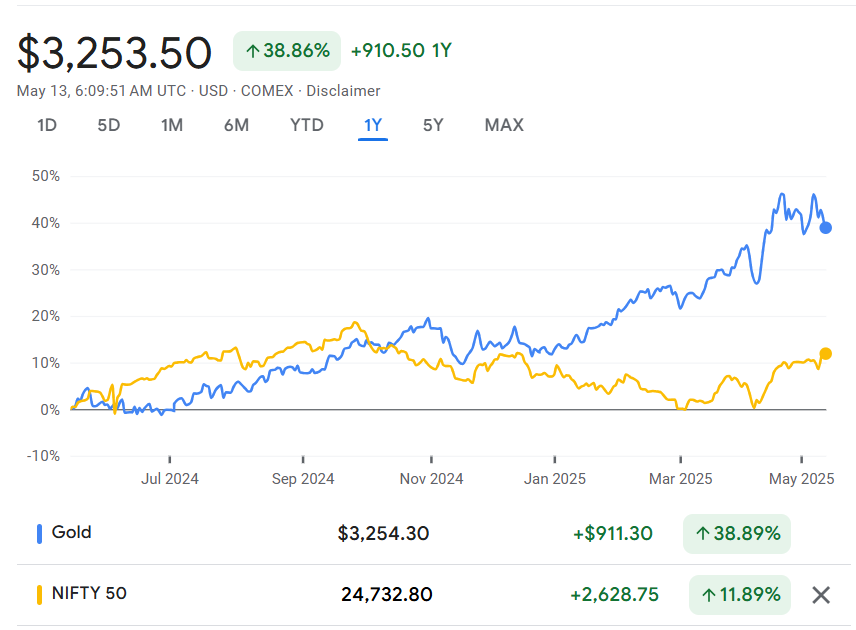

Gold, known as the ultimate safe haven asset, is witnessing a sharp correction after touching its all-time high of $3,503. Currently, the yellow metal is trading at $3,254 — down nearly 7.5% from its recent peak. This decline comes as a result of multiple positive developments on the global geopolitical front, reducing the uncertainty that had previously driven gold prices upward.

There are four major reasons behind this sharp decline in gold prices.

The first reason is the easing tension between India and Pakistan. The recent diplomatic efforts between the two neighboring countries have led to a significant de-escalation in cross-border hostilities. With peace talks progressing,

The second and perhaps the most crucial reason is the improvement in US-China relations. Yesterday, both countries signed a landmark trade agreement in Geneva, Switzerland. As per the agreement, both nations have agreed to reduce tariffs to below 30% from the previous highs of 145%. This trade war was one of the main catalysts behind the massive rally in gold prices over the past year. With tensions easing and trade channels reopening, the need for defensive hedges such as gold is diminishing rapidly.

The third important factor contributing to the fall in gold is the easing of US tariff-related fears. Back in April, President Trump’s sudden tariff declarations had sparked panic across global markets, leading to a spike in gold prices. However, the situation has now taken a turn. President Trump recently announced a 90-day pause on further tariff hikes and has even signed a trade deal with the United Kingdom, further boosting investor confidence and the global trade outlook.

The fourth major reason behind the decline in gold is the recent developments in the Russia-Ukraine conflict. Just two days ago, European leaders gathered in Kyiv and successfully negotiated a ceasefire agreement. Russian President Vladimir Putin has agreed to the ceasefire terms, signaling a potential end to one of the most concerning geopolitical crises in recent times. With this news, global risk sentiment has improved, reducing the appeal of safe-haven assets.

Historically, gold and equity markets have shared a love-hate relationship. When uncertainty grips markets, gold shines and equities suffer. Conversely, when the outlook brightens, equities rally and gold tends to correct. That is exactly what we are witnessing right now. With global tensions easing and a new US-China trade deal boosting market sentiment, US equity markets are rallying strongly. As a result, gold is facing downward pressure.