Adani Enterprises Limited announces its Q4 results on 1st May 2025, in which the net profit of Adani Flagship Company rises by 750% on the exception gain of Rs 3,286 crore, while the net revenue of Adani Enterprises falls by 7% to Rs 26,966 crore as compared to last year.

The company also announced a dividend of Rs 1.3 per share, and Adani Enterprises' net expenses fell to Rs 26,288 crore from Rs 28,308 crore same period last year.

Other Income of Adani Enterprises rises to Rs 636 crore from Rs 450 crore last year same period, while tax expenses sharply rise to Rs 1,284 crore from Rs 430 crore last year, earnings per share rise 10 times to Rs 33 from Rs 3.48 last year.

EBITDA increases by 26% to Rs 26,277 crore

As of Q4FY25, Adani Enterprise's non-current assets stand at Rs 1,57,391 crore from Rs 1,23,871 crore last year, and Adani Enterprise's total debt for Q4 was Rs 3,602 crore, which is a rise from Rs 2,312 crore. Cash and cash equivalents rose to Rs 3,105 crore from Rs 2,306 crore. The last total assets of Adani Ent stand at Rs 2 lakh crore, which rose from Rs 1.60 lakh crore last year.

During the quarter and year ended in March 2025, one of the subsidiaries of the parent company, Mumbai International Limited, recognised annual fees of Rs 627 crore as expenses for the quarter ended in March 2025

During the quarter ended in March 2025, a subsidiary of parent company Adani Commodities Limited agreed with LENCE PTE Limited to grant a simultaneous put option and call option held by ACLLP in the AL agreement business formerly known as Adani Wilmar Limited.

Adani Enterprise's management says that the recent incident, which happened in the USA, is that indictments were filed US DOJ and US SEC in the court of New York against the directors of Adani Enterprise Ltd since this matter does not pertain parent company and there is no impact on results too.

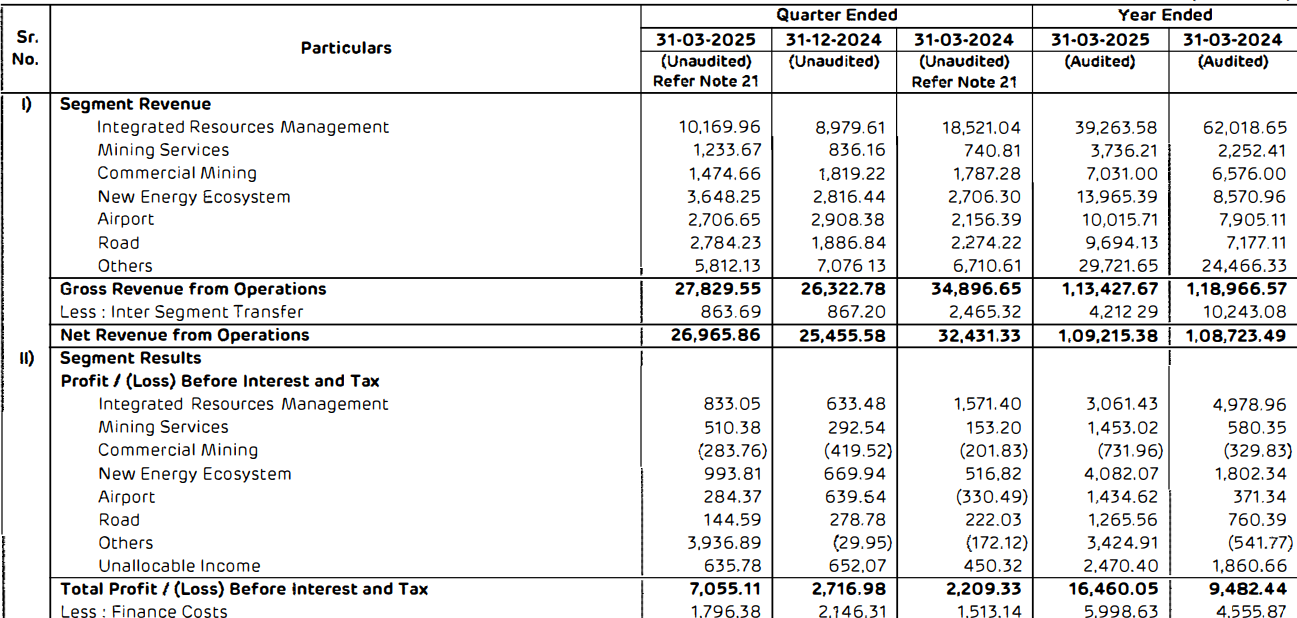

Adani Enterprise segment-wise loss or profit

Disclaimer: This Article is only for informational purposes