According to WhiteOak Mutual Fund’s latest market perspective, a major shift is underway in the Indian stock market. Domestic Institutional Investors (DIIs) are set to surpass Foreign Institutional Investors (FIIs) in ownership of listed equities. As of December 2024, both FIIs and DIIs hold equal ownership at 17.5%, marking a significant narrowing of the gap. If this trend continues, DIIs are expected to take the lead in the next quarter, marking a historic moment for India’s capital markets.

This shift is a result of strong domestic liquidity, increasing retail participation through mutual funds, and a consistent flow of systematic investment plans (SIPs). On the other hand, global uncertainties, policy changes, and risk-off sentiments among foreign investors have led to reduced FII inflows.

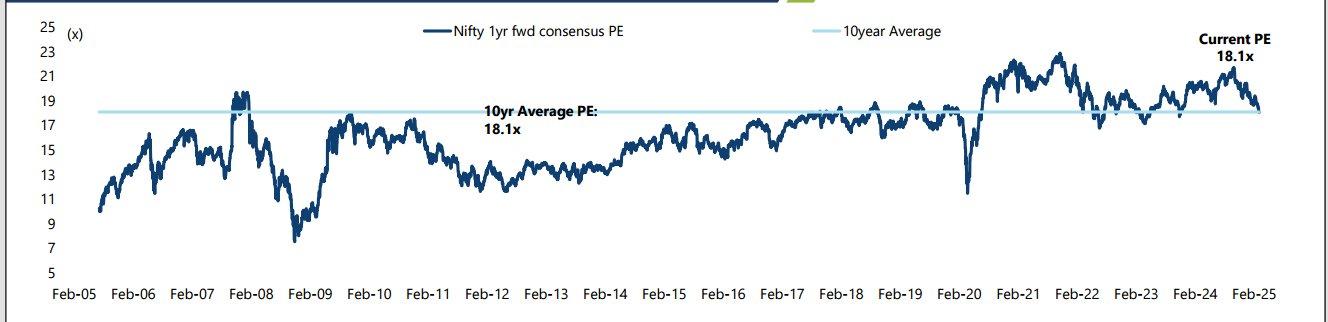

Nifty Back to Its 10-Year Average PE

Another key observation is that the Nifty 50 Index is now trading at a one-year forward price-to-earnings (PE) ratio of 18.1x, aligning with its 10-year average. This suggests that after periods of overvaluation and undervaluation, the market is now fairly valued based on historical trends.

For investors, this could indicate a phase of stability where stock selection becomes crucial. With the valuation back to its historical norm, any market movement from here on will be more influenced by corporate earnings growth and macroeconomic factors rather than valuation re-ratings.

What This Means for Investors

1. DIIs’ Dominance: Retail and institutional domestic investors are gaining more influence, making the Indian market less dependent on foreign capital. This could bring more stability and reduce volatility caused by external shocks.

2. Market Valuation at Fair Levels: With the Nifty PE returning to its 10-year average, investors may find selective investment opportunities rather than broad-based market rallies.

3. Long-Term Growth Potential: Strong domestic participation, economic resilience, and corporate earnings growth could support market expansion in the coming years.

The Indian stock market is at an inflection point. With DIIs poised to become the largest investors in Indian equities and the Nifty back to fair valuation levels, the landscape is shifting towards greater domestic influence. Investors should closely monitor trends in earnings growth and global macroeconomic developments to navigate the next phase of the market cycle effectively.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research or consult a financial advisor before making investment decisions. The data used in this article is sourced from WhiteOak Mutual Fund’s market perspective and may be subject to change.