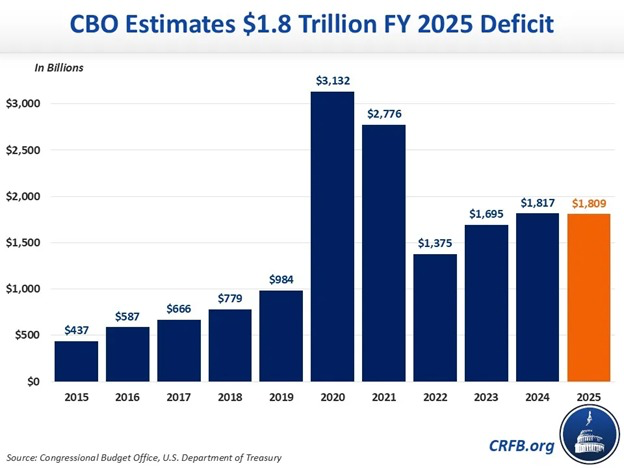

The United States is once again facing a massive fiscal shortfall. According to the latest estimates from the Congressional Budget Office (CBO), the federal deficit for fiscal year 2025 has reached $1.8 trillion, equivalent to about 6.0% of the nation’s GDP. This marks one of the highest deficit levels ever recorded outside of extraordinary events such as World War II, the 2008 Financial Crisis, and the COVID-19 Pandemic.

The data, compiled by the CBO and the U.S. Department of the Treasury, highlights a concerning trend in America’s public finances. The FY 2025 deficit ranks as the fourth-largest budget gap on record, trailing only the unprecedented pandemic-era deficits of $3.1 trillion in 2020 and $2.8 trillion in 2021.

Over the past decade, the U.S. fiscal deficit has seen a sharp increase. In 2015, it stood at $437 billion, gradually rising each year before surging to record highs during the pandemic. After temporarily falling to $1.4 trillion in 2022, the deficit has once again climbed, reflecting sustained spending pressures and higher interest costs.

One of the most alarming elements in the 2025 data is the explosion in interest payments on government debt. These payments have increased by $80 billion compared to last year, surpassing $1 trillion for the first time in U.S. history. This means that the federal government now spends more on servicing its debt than on key programs such as defense or Medicare.

Economists warn that the U.S. debt crisis is entering a critical phase. With rising borrowing costs, an aging population, and persistent budget deficits, the long-term fiscal outlook remains fragile. The CBO’s latest figures suggest that without significant policy reforms, the country could face even larger deficits in the coming years.

The chart released by CRFB.org vividly illustrates this growing imbalance, showing a steady climb in federal deficits since 2015, with only temporary relief after the pandemic. The $1.8 trillion shortfall in FY 2025 underscores the scale of the fiscal challenge now confronting policymakers in Washington.

Source: Congressional Budget Office, U.S. Department of the Treasury, CRFB.org

Disclaimer:This article is based on publicly available data and estimates from the Congressional Budget Office (CBO), the U.S. Department of the Treasury, and CRFB.org. It is intended for informational purposes only and does not constitute financial or investment advice.