I am Niranjan Ghatule, a B.Tech graduate in Electrical Engineering with a strong passion for the financial markets. With over 5 years of hands-on experience in the stock market, I have developed deep expertise in equity research, market analysis, and trading strategies.

Posts by Niranjan Ghatule:

LIC has made major changes to its ₹15.5 lakh crore equity portfolio, increasing stakes in defence stocks like Mazagon Dock and HAL, tech giants Infosys and HCL Tech, and companies like Tata Motors and Jio Financial. At the same time, LIC trimmed holdings in popular stocks such as Hero MotoCorp, Vedanta, and Suzlon. This reshuffle highlights LIC’s strategic sector focus on defence, PSU banks, renew

Zomato's Q1 FY26 results reveal a shocking 90% profit drop, yet the stock has surged over 16% in just two days. But is Zomato really profitable? We decode the real numbers behind the ₹300+ stock price, explore FD-driven profits, Blinkit’s rise, business cannibalization, and why this ₹3 lakh crore valuation might be a bubble in the making.

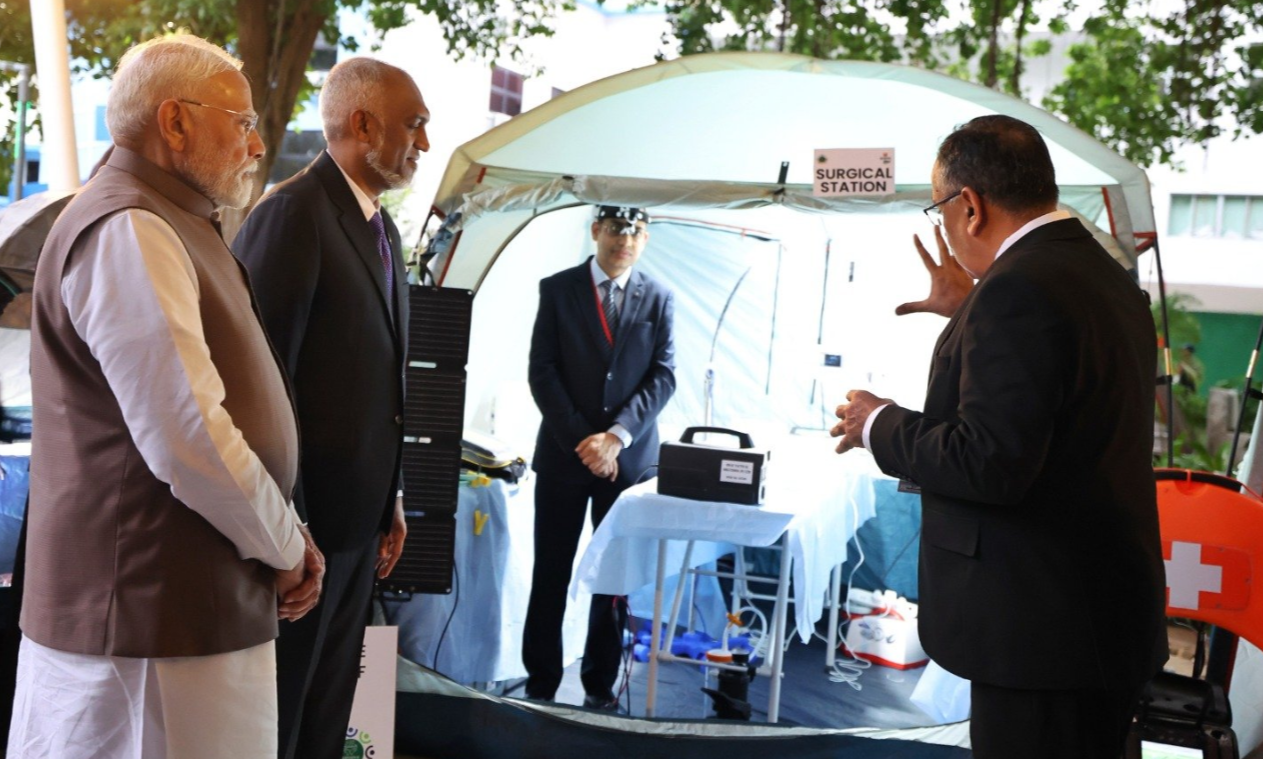

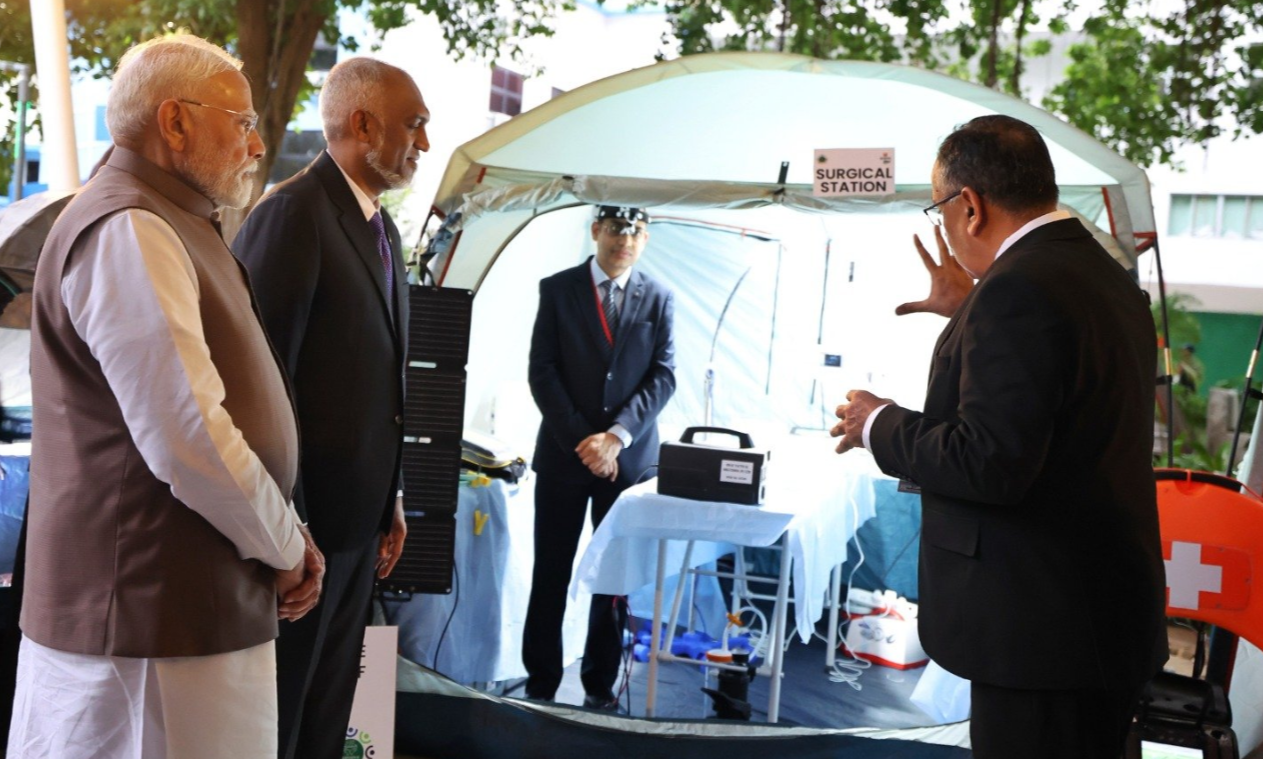

India has extended a ₹4850 crore loan to the Maldives during Prime Minister Narendra Modi’s high-profile visit as Chief Guest on Maldives' Independence Day. This marks a significant diplomatic shift, with both nations signing major agreements across defense, trade, housing, and healthcare.

U.S. President Donald Trump has issued a strong warning to tech giants like Google and Microsoft, asking them to stop hiring talent from India and China. Speaking at a major AI Summit, Trump criticized American companies for outsourcing jobs and called for a patriotic shift in Silicon Valley's priorities.

Nayara Energy has boldly countered the European Union’s latest sanctions targeting Russian oil refined in third-party countries, including India. After being named in the EU’s 18th sanctions package, Nayara canceled a fuel tender to an EU buyer over strict payment terms and redirected the cargo to the Middle East at a premium.

Bajaj Finance stock drops 4% after management flags rising customer over-leverage and stress in both unsecured and secured loan segments. Q1 results showed an increase in NPAs to 0.50%, and growth in AUM is expected to slow. JPMorgan downgrades the stock from Overweight to Neutral. The stock is now down 8% from its all-time high.

Tata Sons Chairman N. Chandrasekaran earned ₹156 crore in FY 2024–25, even as company profits fell 24%. This article explores what this massive salary means for India’s rising income inequality and what impact such wealth could have if redirected to public development.

India's ethanol blending program has seen massive growth in recent years, becoming a key pillar in the country’s energy strategy. In this article, we decode the rise of ethanol as a future-oriented sector, its multiple use cases, government policy support, risks, and the companies that stand to gain.

India's ethanol blending program has seen massive growth in recent years, becoming a key pillar in the country’s energy strategy. In this article, we decode the rise of ethanol as a future-oriented sector, its multiple use cases, government policy support, risks, and the companies that stand to gain.

A comprehensive roundup of today's key Q1 earnings from top Indian companies including Nestle, Bajaj Finance, Canara Bank, Adani Energy, SBI Life, Supreme Industries, and more. This blog covers profit and revenue trends, margin movements, and key financial indicators to help you stay informed about market developments.

The UK and India have signed a landmark free trade agreement, marking the most comprehensive economic pact for India and the most significant for the UK post-Brexit. Expected to boost the UK economy by £4.8 billion annually, the deal lowers prices for British consumers and strengthens bilateral ties.

The Indian Energy Exchange (IEX) has suffered a massive stock crash following the government’s approval of market coupling. This blog explains what market coupling is, why it impacts IEX so significantly, how competitors may benefit, and what it means for investors.