The Indian automotive sector is firing on all cylinders in 2025, fueled by a potent mix of government incentives like GST cuts on vehicles, a rebound in rural demand, and surging exports. The Nifty Auto Index has rocketed nearly 19% year-to-date (YTD), outpacing the Nifty 50's 12% gains, and touched an 11-month high of 27,696 in early September.

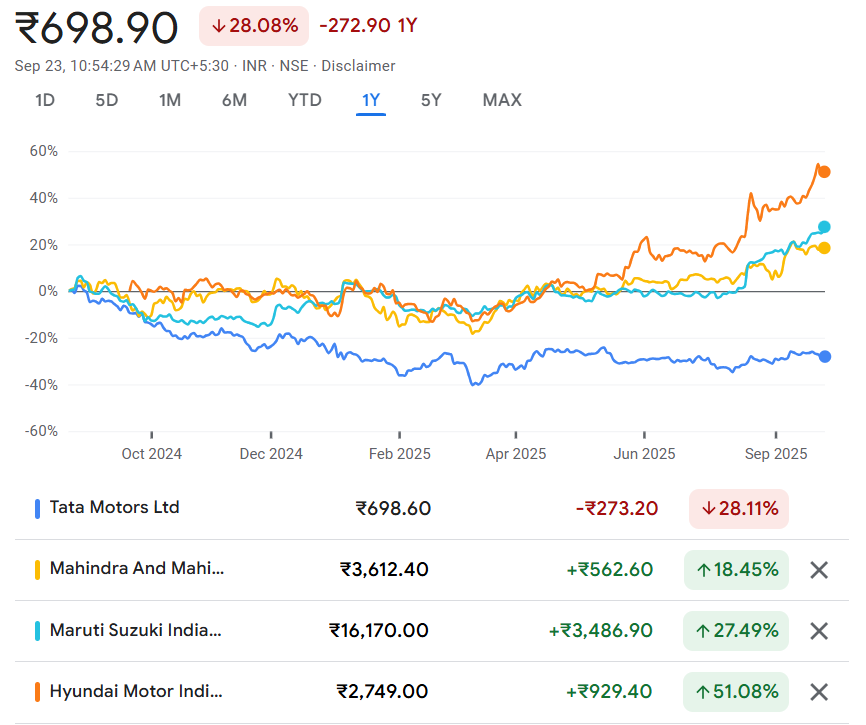

Stocks like Mahindra & Mahindra (M&M) and Eicher Motors have notched all-time highs, rewarding investors with blockbuster returns. Yet, in this sea of green, Tata Motors stands out as the glaring underperformer—trading perilously close to its 52-week low amid slumping EV sales and Jaguar Land Rover (JLR) woes. The question for investors is simple: Is this a classic value trap or a screaming buy for patient holders?

The Sector Surge: Why Auto Stocks Are Racing Ahead in 2025

India's auto industry, valued at $137 billion as of August 2025, is projected to swell to $203 billion by 2030 at an 8.2% CAGR, driven by 4.3 million domestic passenger vehicle sales in FY24-25 and EV adoption.

Key tailwinds include:

Policy Boosts: A September 4 GST slash on consumption taxes propelled the Nifty Auto up 3.7% in a single day, with FIIs pumping in ₹4,500 crore ahead of the festive "GST Bachat Utsav."

Demand Revival: Urbanization, rising middle-class incomes, and favorable monsoons have juiced two-wheeler and tractor sales. Exports hit 4.5 million units in FY24, with Africa and Latin America as hotspots.

EV Momentum: Government schemes like FAME II (despite its expiry) and budget incentives for EVs have companies like M&M and TVS Motor gearing up for 30% EV penetration by 2030.

The result is a sector-wide rally, with the Nifty Auto up 67% over two years and 103% in three. But not all ships are rising equally.

Tata Motors: Trading at 52-Week Lows Amid Sector Euphoria

While peers celebrate, Tata Motors (TATAMOTORS.NS) is nursing wounds, closing at ₹705 on September 23—down 0.35% for the day and a dismal -27% YTD.

That is 38% off its 52-week high of ₹1,142 (hit late 2024) and hovering near the low of ₹535-₹542.

Key financials (Q1 FY26, ended June 2025):

Market cap: ₹2.60 lakh crore

Revenue: ₹1,05,926 crore (down 3.37% YoY, 12.47% QoQ)

Net Profit: ₹3,924 crore (down 62.68% YoY)

ROE: 23.96% (above 5Y avg. 10.62%, but slipping)

P/E: 11.88 (vs. sector 22.94, undervalued on paper)

Dividend Yield: 0.85%

Promoter Holding: 42.6% (down 3.83% over 3 years); FII: 17.17%; MF: 10.18%

Why is Tata Motors underperforming?

EV Market Share Erosion: Tata's early-mover edge with the Nexon EV has faded post-FAME II expiry. Sales have spiraled downward, with MG Windsor's single model outselling Tata's entire EV lineup. Competitors like M&M, Hyundai, and Maruti are launching aggressively and taking share.

JLR Headwinds: The UK subsidiary, which contributes 60% of Tata's revenue, faces U.S. tariffs under Trump 2.0, rupee depreciation, and Jaguar’s stalled rebranding efforts. Production was halted until September 24 due to cybersecurity issues, further denting sales.

Volume & Margin Pressure: Passenger vehicle sales rose just 2% YoY, compared to M&M’s 16%. EBITDA missed estimates due to high input costs and weak festive demand spillover from late 2024.

Demerger Uncertainty: Tata is set to split into two entities on October 1—Tata Motors Passenger Vehicles Ltd. (PV) and a new TML entity for CVs. While aimed at unlocking value, this move has spooked short-term traders.

Tata’s 5-year CAGR of 58.54% was stellar, but its -27% performance in 2025 compared with Nifty Auto’s +19% is a stark warning sign.

Is Tata Motors a Value Buy? Analyst Verdict and Outlook

At a P/E of 11.88 (half the sector average) and trading 35% below intrinsic value estimates of ₹815–₹854, Tata Motors looks like a bargain.

Analyst coverage (27 firms) gives a median 12-month target of ₹719, a modest 2% upside. Opinions are divided.

Bull case:

Demerger unlock could create two agile entities, with the CV spin-off fetching premium valuations.

Jefferies sees a long-term EV rebound, while WalletInvestor forecasts ₹845 by end-2025.

Figw models a range of ₹698–₹1,111, with 2026 highs at ₹1,373.

ICICI Direct maintains a "Buy" rating, citing strong fundamentals, debt-free trajectory, ₹33,800 crore TTM profit, and a healthy ROE of 24%.

Bear case:

InCred recommends "Reduce" due to prolonged volume weakness and JLR tariff risks.

Kotak downgraded to "Reduce," with a target of ₹600.

Livemint notes several analysts rating "Sell" due to plunging profits and mounting EV competition.

Key risks remain geopolitical tariffs, subsidy cuts, and the fact that 70% of retail-favorite stocks, including Tata, are in the red this year.

My take: Tata Motors is a cautious value buy for investors with a 2-3 year horizon. At current levels, it appears undervalued with demerger catalysts on the horizon, but near-term volatility from JLR and EV challenges could drag it down to the ₹650 support zone. Accumulation below ₹700 looks attractive, with potential post-demerger targets of ₹800–₹900. However, diversifying into stronger performers like M&M or Bajaj Auto may provide stability.

The auto rally of 2025 isn’t over, but Tata’s stumble is a reminder that even giants can trip in booming markets. Investors should watch Tata’s Q2 earnings on November 14 closely for fresh clues.

Disclaimer: This article is for informational purposes only and not investment advice. Please consult a financial advisor before making investment decisions. Data sourced from NSE, BSE, and analyst reports as of September 23, 2025.