As the United States approaches the final days of 2025, two major policy decisions remain unresolved, both of which carry significant economic and national security implications. One is the Supreme Court’s pending ruling on President Donald Trump’s authority to impose tariffs under emergency powers. The other is the president’s decision on who will be appointed as the next Chair of the Federal Reserve.

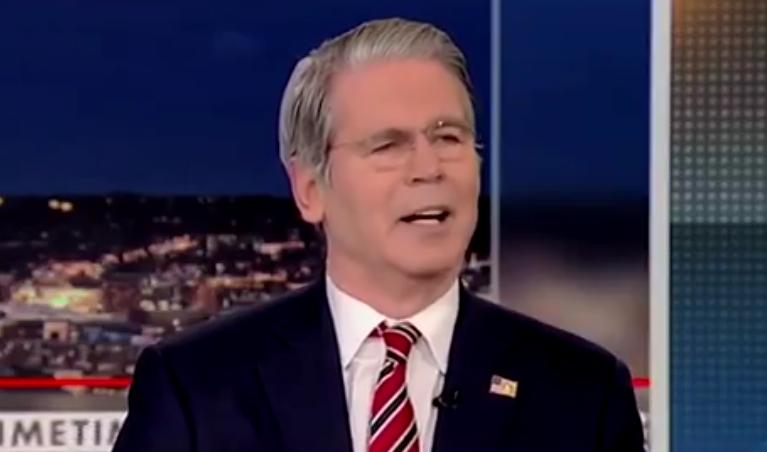

In an exclusive television interview, Treasury Secretary Scott Bessent provided insight into both issues, signaling that neither decision is expected before the end of the year and will likely be finalized in early January.

According to Secretary Bessent, the administration believes the Supreme Court case on tariffs is fundamentally a national security matter. He emphasized that President Trump’s use of emergency tariff powers under the International Emergency Economic Powers Act has had tangible results, particularly in addressing the fentanyl crisis. He cited a substantial decline in fentanyl-related deaths following the imposition of tariffs on China, Mexico, and Canada, and noted that China has begun cooperating on fentanyl control for the first time in more than a decade.

Bessent also pointed to a recent episode involving rare earth magnets, stating that when China attempted to impose export controls, the administration responded by threatening a 100 percent tariff. According to him, this prompted immediate negotiations, reinforcing the administration’s view that tariffs are an effective tool for economic and national security. He added that trade rebalancing efforts are expected to shrink the U.S. trade deficit by several hundred billion dollars in the current calendar year.

The Treasury Secretary warned that if the Supreme Court rules against the administration, it would represent a loss not just of tariff revenue but of national security leverage. While alternative revenue mechanisms exist, he argued that none offer the same strategic benefits as tariffs tied to emergency powers.

On monetary policy, attention is focused on President Trump’s upcoming decision regarding the next Federal Reserve Chair. Current Chair Jerome Powell’s term ends in mid-May, but the administration is expected to announce a successor well before then.

President Trump has publicly indicated that he is leaning toward either Kevin Hassett or Kevin Warsh. Secretary Bessent confirmed that multiple interviews have already taken place, with additional discussions expected in the coming weeks.

He described both candidates as highly qualified, noting that Hassett brings a strong academic and economic policy background, while Warsh offers legal expertise, financial market experience, and prior service as a Federal Reserve governor. Addressing criticism that Hassett may be too close to the president, Bessent rejected the argument, pointing out that previous Federal Reserve leaders, including Janet Yellen and Lael Brainard, have moved between advisory roles and central bank leadership positions without compromising independence.

A recurring theme in the interview was the Federal Reserve’s loss of credibility. Both candidates, according to Bessent, agree that the Fed must rebuild trust not only with markets and businesses but also with the American public. He criticized the Fed for being backward-looking in its policy approach and for failing to prevent what he described as the worst inflation experienced by working Americans in more than 50 years.

The discussion also highlighted concerns about interest rate policy. President Trump has suggested that the Federal Reserve should consult more closely with the White House and has signaled a preference for rates closer to one percent. Secretary Bessent noted that the administration is focused on forward-looking productivity growth, particularly driven by artificial intelligence, rather than reacting to outdated economic data.

Looking ahead to 2026, Bessent expressed strong optimism about the macroeconomic outlook. He described 2025 as a year that “set the table,” predicting that the following year could be exceptionally strong if political disruptions are avoided. He warned that another government shutdown, similar to previous shutdowns led by Democratic opposition, could undermine economic momentum.

Despite these risks, the administration expects GDP growth of approximately three to three and a half percent for the year, even as the federal budget deficit shrinks by more than $400 billion. Bessent highlighted a broadening of economic growth beyond big technology firms, with increased capital expenditure across multiple sectors.

A key driver of this expansion, he said, is the administration’s “big beautiful bill,” which includes 100 percent expensing provisions. These measures allow businesses to immediately deduct the cost of equipment, vehicles, and technology investments, effectively increasing after-tax returns on capital. According to Bessent, this investment surge historically leads to higher productivity and job creation.

He contrasted this approach with the previous administration’s spending policies, arguing that trillions of dollars in stimulus led primarily to higher debt rather than durable economic gains. In his view, the current policy framework is building productive capital stock rather than inflating consumption.

On inflation and affordability, Bessent acknowledged ongoing stress among households, particularly related to housing and food costs. He attributed much of the problem to what he called “Biden-era inflation,” citing a cumulative inflation impact of roughly 35 percent on working Americans, driven largely by essentials such as groceries, rent, insurance, and transportation.

He stated that inflation is now easing, led by falling energy prices, which feed through to food costs. He also pointed to declining rents, linking earlier rent increases to mass immigration. Referencing a Wharton School study, Bessent noted that every one percent increase in population was associated with a one percent increase in rents. With stricter border enforcement and deportations, he said rental markets in cities such as Washington, D.C. are already showing signs of cooling.

Bessent added that mortgage rates have begun to decline and expects broader affordability improvements over the next six months. He emphasized that while inflation may slow, the absolute price level remains elevated, making real wage growth critical. According to him, rising productivity, tax relief measures, and changes in withholding will increase real incomes for working Americans.

The Treasury Secretary concluded by expressing confidence that the economy is moving toward what he described as “parallel prosperity,” where both Main Street and Wall Street benefit simultaneously. He predicted strong wage growth, higher investment, and improved household finances in the coming year, setting the stage for a robust economic expansion in 2026.

DISCLAIMER

This article is based on a publicly available television interview transcript and reflects statements, opinions, and policy positions expressed by the participants during the discussion. The content is for informational and news reporting purposes only and does not constitute financial, investment, legal, or policy advice. Readers are advised to consult official government releases and qualified professionals before making any decisions based on this information.