India's leading food aggregator, Eternal(Formerly known as Zomato), reported its March quarter results today. The net profit of Eternal slumps more than 78% to Rs only 39 crore. In the same period last year, the company reported a net profit of Rs 161 Crore. While company's net revenue for the March quarter rises by 64% to Rs 5,833 Crore. During the same period last year company generated revenue of Rs 3,797 Crore.

- Net Profit of eternal down due to higher expenses. In the March quarter company's net expenses stood at Rs 6,104 crore, which is almost double compared to the same period last year. In Q4FY24, Eternal's net expenses were Rs 3,636 crore. In the last quarter company spent more than Rs 600 crore on advertising. In the last year company spent only Rs 340 crore on advertising

- Earnings per share of Eternal for Q4FY25 stood at Rs 0.04, which is down from Rs 0.20 same period last year.

- Operating profit margin for Q4FY25 is down by 120 bps compared to last, and it stands at 1.2%

- EBITDA down 16.3% as compared to last year at Rs 72 Crore

As of Q4FY25, Eternal has total Rs 35,623 crores worth of assets, of which cash is Rs 2,948 crores and bank balance and other cash equivalents are Rs 2769 crores.

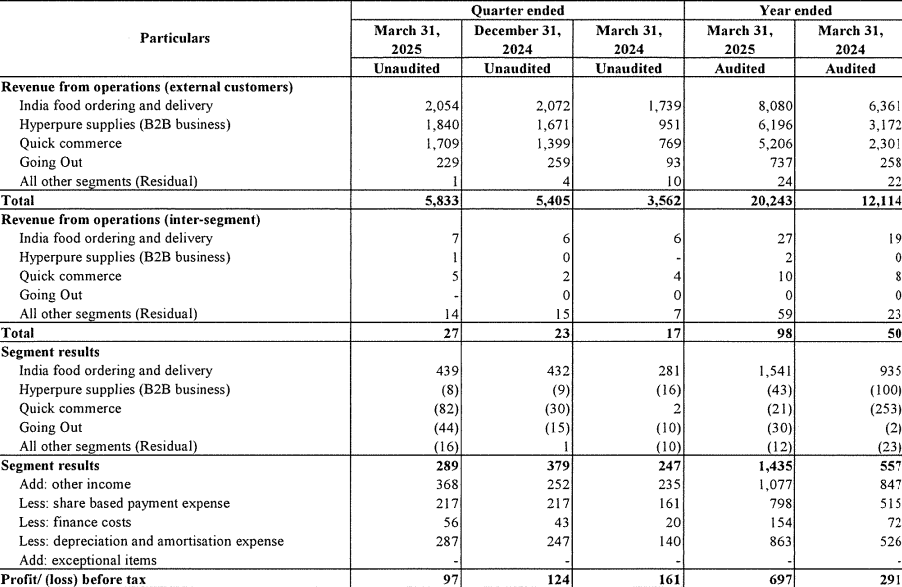

Consolidated Segment revenue

Blinkit added the highest ever 294 new stores in Q4FY5, and it is on track to get 2,000 stores by December 2025

Management commentary on competition

Management says that competition is going to intensify further from here in the near term. This is the latest consumption category in the country and beyond, just the early quick commerce players, and we will continue to see competition from next-day delivery companies that are investing more quickly in deliveries, especially in non-commerce categories.