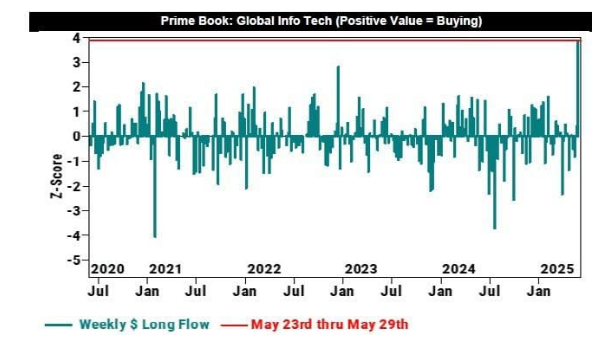

Hedge funds made an aggressive move into global technology stocks during the week of May 23rd through May 29th, marking the strongest weekly buying activity recorded in at least five years. This extraordinary surge in buying was reflected in a Z-score that spiked to the highest point on record in the dataset, indicating that the scale of hedge fund purchases was far beyond typical historical activity.

The data measures weekly dollar long flows—net buying and selling by hedge funds in the global information technology sector. A positive Z-score signals net buying, while a negative score indicates net selling. The most recent week’s Z-score pushed to the extreme upper limit of the scale, suggesting hedge funds poured money into tech stocks at an unprecedented pace.

Looking back over the last five years, the weekly flow trends offer valuable insight into hedge fund behavior:

2020: The year began with moderate fluctuations in buying and selling, but during the pandemic onset in March, there was a sharp drawdown with Z-scores dipping below -4. This reflected intense selling pressure. However, recovery followed quickly with several strong weeks of buying by mid-year.

2021: A year characterized by alternating patterns of buying and selling. There were notable spikes in early and mid-2021 with Z-scores reaching above +2, indicating bullish sentiment. Still, the buying was interspersed with weeks of mild to moderate selling, pointing to cautious positioning.

2022: This year saw elevated volatility in flows. Hedge funds exhibited sharp bursts of buying—several weeks in 2022 recorded Z-scores exceeding +2—but these were countered by equally aggressive selling, with multiple dips near or below -3. The year appeared to be a tug-of-war, reflecting uncertainty around tech valuations and broader macro conditions.

2023: Buying patterns were more controlled but frequent. Although Z-scores remained mostly within a +/-2 range, there were a few weeks with spikes in buying, hinting at more consistent confidence returning to the tech sector. There was one notable surge early in the year above +3, though it didn’t match the intensity seen in the latest 2025 data.

2024: The pattern shifted slightly toward net selling. While occasional buying weeks occurred, most of the activity hovered around neutral or slightly negative Z-scores. This suggests that hedge funds reduced exposure or rotated out of tech stocks for a portion of the year.

2025 (Year-to-Date): Leading up to the record-setting buying week in late May, the year had been relatively muted. Weekly flows were mostly stable with minor net selling. However, the sudden and dramatic spike during May 23rd–29th represented a powerful reversal of sentiment.

This recent activity not only dwarfs all previous spikes but also demonstrates a level of confidence in tech stocks that has been absent for several years. Such large-scale repositioning could be linked to optimism around innovation themes like artificial intelligence, semiconductors, or improving fundamentals in major technology firms.

Hedge funds are often regarded as early movers in market cycles, and their current posture may signal the beginning of a new bullish phase for global information technology stocks. As always, investors will be closely watching whether this surge was a one-off move or the start of a sustained rotation back into the sector. Either way, this is a historic moment for tech flows, reflecting hedge funds’ strongest conviction in over half a decade.

Disclaimer:

The information provided in this article is for educational and informational purposes only. It does not constitute investment advice, financial advice, or trading recommendations. All investment strategies and investments involve risk of loss. Readers should conduct their own research or consult with a licensed financial advisor before making any investment decisions. The content reflects data trends and market activity up to May 29, 2025, and may not be indicative of future results.