Bubbles look good in fairs, but in the stock market, they can be dangerous. However, investors often can’t resist the temptation. This was evident last week when NSDL came out with its IPO. The IPO was priced at ₹800 per share, and upon listing, investors immediately enjoyed a 10% gain — a decent start.

But what happened next took everyone by surprise. That 10% gain wasn’t enough for some market participants. They wanted not double, not five times, but eight times that gain — aiming for an 80% profit. This frenzy drove NSDL’s stock from ₹800 to ₹1,300, pushing its P/E ratio to a steep 75.

Naturally, the question began to arise — is this kind of growth truly justified when looking at the company’s fundamentals, or has the stock entered dangerous territory where valuations are detached from business performance?

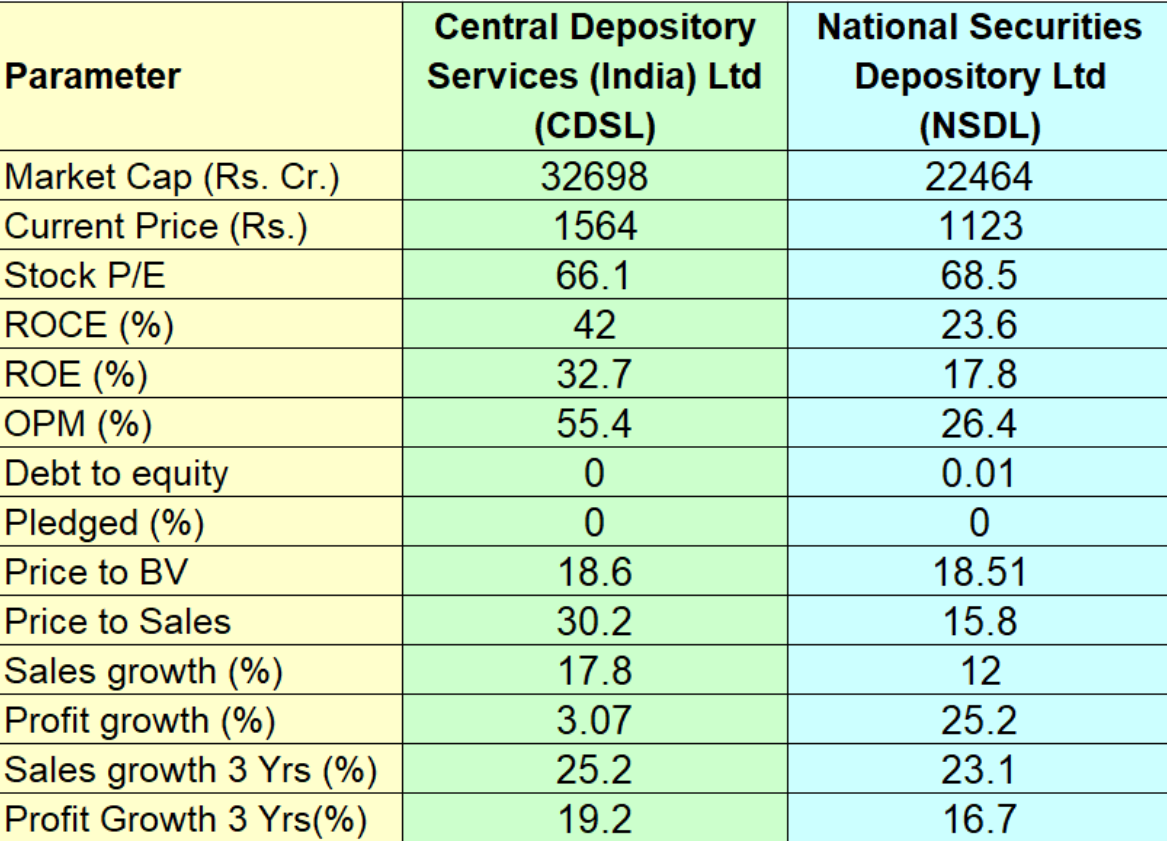

In this article, we will dive deep into NSDL’s fundamentals, valuation study, and how it compares with its counterpart CDSL.

Understanding the Business Model

NSDL (National Securities Depository Limited) operates in a specialized segment of the financial market — it is a depository, similar to a bank, but instead of holding cash, it stores shares. There are two depositories in India: CDSL (Central Depository Services Limited), which is already listed, and NSDL, which has just been listed.

Many people make the mistake of directly comparing NSDL and CDSL as if they are direct competitors. In reality, they operate in different areas. CDSL primarily caters to retail investors, while NSDL serves institutional investors like domestic institutional investors (DIIs), mutual funds, insurance companies, and foreign portfolio investors (FPIs).

Because institutional investors hold far larger amounts of assets, NSDL has a massive “Assets Under Custody” (AUC) figure despite having fewer accounts.

Comparing CDSL and NSDL

CDSL dominates the retail segment. India has 20 crore Demat accounts, out of which 15.86 crore — nearly 79% — are with CDSL. This dominance helped CDSL deliver 10x returns over the past eight years.

However, when it comes to assets under custody, NSDL leads. NSDL’s AUC stands at ₹510 lakh crore compared to CDSL’s ₹79 lakh crore. This is because institutional accounts, which NSDL handles, are far larger in size.

On average, one NSDL Demat account holds ₹1.2 crore worth of securities, while a CDSL account holds around ₹4.6 lakh. If we exclude HUFs and NRIs, the average drops to just ₹2.2 lakh for CDSL accounts.

Revenue Model Differences

Despite holding larger assets, NSDL’s profits are lower than CDSL’s. In FY2024, NSDL’s profit was ₹343 crore, while CDSL’s was ₹526 crore — about 53% higher.

This difference comes from the revenue model. NSDL earns mainly from transaction fees and custody fees, with custody fees alone contributing ₹235 crore last year. CDSL, on the other hand, has a more diversified revenue stream, including annual issuer charges, IPO charges, e-voting services, and corporate action fees.

Both companies charge custody fees directly to companies that issue shares, making it a recurring revenue source.

Why Do FPIs Prefer NSDL?

A striking fact is that 99.99% of foreign institutional investors are with NSDL. This preference dates back to the mid-1990s when NSDL was the only depository authorized to issue ISIN numbers (International Securities Identification Numbers) — a unique 12-digit code for each security.

When FPIs first entered India, they had no choice but to open accounts with NSDL. Their systems and infrastructure were integrated with NSDL, making a switch to CDSL unnecessary, even after CDSL eventually gained ISIN authority.

Growth Analysis

As of June 2024, NSDL’s AUC was ₹100 lakh crore. By June 2025, it had grown to ₹510 lakh crore — a CAGR of 16%. This growth is largely linked to the rise of the mutual fund industry, whose AUM recently hit an all-time high of ₹72 lakh crore. Almost all mutual funds have their Demat accounts with NSDL.

However, while AUC has grown, NSDL’s net profit growth between 2018 and 2025 has been around 20% CAGR. CDSL, in comparison, grew profits at a 29% CAGR during the same period.

This raises a key question: can NSDL sustain its growth in line with the institutional investor segment? Given that its business is heavily dependent on mutual fund and institutional growth, any slowdown in these areas could affect NSDL’s performance.

The Valuation Question

Currently, NSDL trades at a P/E ratio of 75. High P/E valuations can be justified if a company is growing profits at 70–80% annually. However, with NSDL’s profit growth at 15–20%, the justification becomes less clear.

Investors must consider whether the current price factors in both the present growth rate and realistic future potential. The market frenzy may have pushed valuations far ahead of fundamentals.

Final Thoughts

While NSDL is a strong player in the institutional depository space and holds significant advantages due to its history and client base, its limited revenue diversification compared to CDSL and its reliance on a few major income sources present risks.

For now, the market seems to be betting on its dominance in the institutional space and its future growth potential. But with valuations at these levels, investors should tread carefully and keep an eye on both profit growth and diversification of revenue streams.

Disclaimer:

This article is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy, sell, or hold any securities. Stock market investments are subject to market risks, including the risk of losing principal. Readers should conduct their own research or consult a qualified financial advisor before making any investment decisions. The information provided is based on publicly available data believed to be accurate at the time of writing, but no guarantees are made regarding its completeness or accuracy