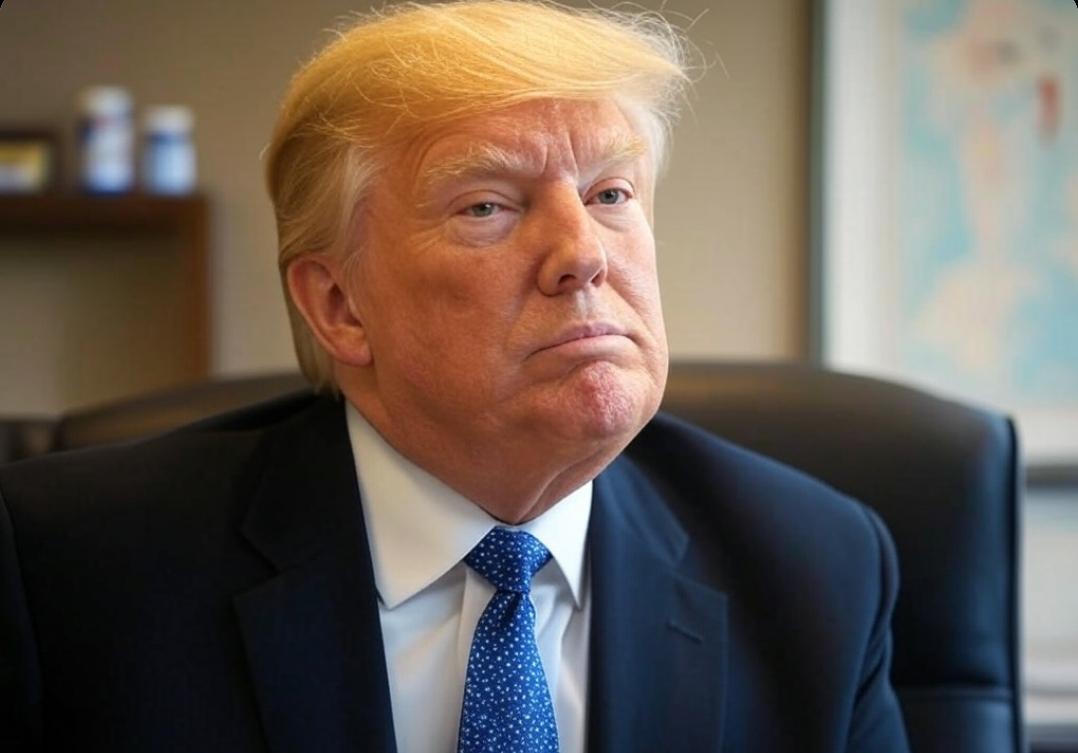

Amid renewed talks of a 25% tariff on pharmaceutical imports by US President Donald Trump, Indian pharmaceutical companies could face significant challenges. The United States is a key market for several Indian pharma giants, and any tariff hike could directly impact their revenues and profitability.

Revenue Dependency on US Market

The US market contributes a substantial portion of revenues for many Indian pharmaceutical companies. Here's a look at the revenue exposure of some leading firms:

Aurobindo Pharma: 46%

Dr. Reddy's Laboratories: 46%

Lupin: 37%

Cipla: 28%

Torrent Pharmaceuticals: 10%

With such high dependency on the US market, these companies are vulnerable to any tariff changes, which could directly impact their earnings.

Impact of a 10% Tariff on Earnings Per Share (EPS)

An analysis by HSBC highlights the potential impact of a 10% tariff on the Earnings Per Share (EPS) of these companies:

Dr. Reddy's Laboratories: -6.5%

Zydus Lifesciences: -6%

Aurobindo Pharma: -5.5%

Lupin: -4.5%

Cipla: -4%

Sun Pharma: -1%

Torrent Pharmaceuticals: -0.8%

If the proposed 25% tariff is implemented, the impact on EPS would be even more significant, potentially affecting investor sentiment and stock valuations.

Strategic Challenges and Adaptations

To mitigate the impact, Indian pharma companies may need to explore strategic adaptations such as:

Cost Optimization: Streamlining operations to reduce costs and offset tariff expenses.

Diversification: Expanding to other markets to reduce dependency on the US.

Local Manufacturing: Increasing manufacturing within the US to bypass import tariffs.

Disclaimer:

The information provided in this article is for informational purposes only and should not be construed as financial or investment advice. The analysis is based on publicly available data and reports, including insights from HSBC. Market conditions and regulatory policies are subject to change, which may impact the financial performance of the companies mentioned. Readers are advised to conduct their own research or consult with a financial advisor before making any investment decisions. Sensexnifty.com is not responsible for any investment losses incurred based on the information provided in this article.