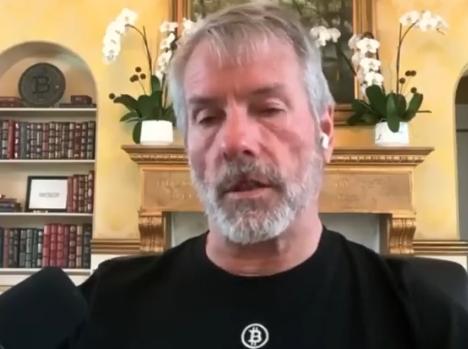

Bitcoin has entered negative territory for the first time since 2023, raising concerns among new investors as market volatility returns. Speaking with host Charles, MicroStrategy Founder and Executive Chairman Michael Saylor addressed the recent downturn and reinforced the long-term value proposition of the world’s largest cryptocurrency.

Saylor emphasized that Bitcoin has experienced 15 major drawdowns over its 15-year history, yet it has always returned to achieve new all-time highs. According to him, the decline is a normal part of the lifecycle of a transformative asset class.

He noted that market corrections help eliminate speculative leverage and weak holders, ultimately preparing the foundation for the next upward rally. Despite criticism that institutional involvement would reduce volatility, Saylor believes volatility has gradually decreased. He explained that Bitcoin was once an 80 volatility asset growing 80 percent annually, then reduced to 70, 60, and is currently around 50 volatility while maintaining approximately 50 percent annual growth, and is likely to become 1.5 times as volatile as the S&P 500 while outperforming it by the same multiple.

On the rise of alternative crypto assets, blockchain innovation, and gold gaining traction this year, Saylor acknowledged their importance but stressed that Bitcoin remains the strongest digital asset for sound-money advocates seeking long-term security and protection from counterparty risk. Other speculative opportunities, he added, may be better suited for technology-focused investors.

Discussing MicroStrategy’s share performance, Charles noted that the stock has come under pressure. However, Saylor pointed out that the company is still one of the top-performing firms over the last five years, alongside names such as Nvidia. He stated that MicroStrategy is currently the best-capitalized company in the crypto economy with more than 50 billion dollars in equity and significant daily liquidity.

Saylor explained that the company raises capital by issuing equity and digital credit instruments to invest directly into Bitcoin. These instruments offer a 10 percent dividend yield structured for tax efficiency. Based on historical performance, Saylor projected that Bitcoin may continue appreciating at approximately 30 percent annually over the next two decades.

He added that MicroStrategy’s business model is resilient enough to withstand even an 80-90 percent drawdown in Bitcoin’s price. With leverage reduced to around 10-15 percent and trending toward zero, Saylor said the company is engineered to survive extreme downside scenarios without collapsing.

When asked about investor worries regarding further declines, Saylor maintained confidence, saying that the company could sustain dividend payouts indefinitely as long as Bitcoin increases more than 1.25 percent annually. Even if Bitcoin’s appreciation halted entirely, he stated that MicroStrategy would still have nearly 80 years to adapt.

Charles praised Saylor for remaining publicly committed to Bitcoin through periods of intense pressure, crediting him for consistently standing firm.

Disclaimer:This article is for informational purposes only and should not be considered financial or investment advice. Cryptocurrency markets are highly volatile and investors should conduct their own research or consult financial professionals before making decisions.