In a major step towards building a globally competitive semiconductor ecosystem, the Union Cabinet has approved ₹4,600 crore for four new semiconductor projects spread across Odisha, Punjab, and Andhra Pradesh. This latest push marks another milestone in India’s journey to becoming a global hub for semiconductor manufacturing and electronics production.

ESDM Market – India’s Rapid Growth Path

India’s Electronics System Design and Manufacturing (ESDM) industry is on a strong growth trajectory, projected to expand from $102 billion in FY23 to $300 billion by FY26. Exports are expected to surge from $24 billion to $120 billion in the same period.

In FY23, domestic electronics production was valued at $102 billion, accounting for 3.75% of global electronics manufacturing. The gap between demand and supply is narrowing through import substitution and an aggressive export push, supported by policy incentives and state-level programs.

India’s Semiconductor Potential – A $110 Billion Opportunity by 2030

The Indian semiconductor market, currently valued at $44 billion (2023), is forecast to touch $110 billion by 2030, capturing nearly 10% of the global market.

By application in 2030:

Handsets: $33B

IT: $20B

Telecom: $14B

Industrial Electronics: $10B

Consumer Electronics: $11B

Automotive: $8B

Aerospace & Defence: $6B

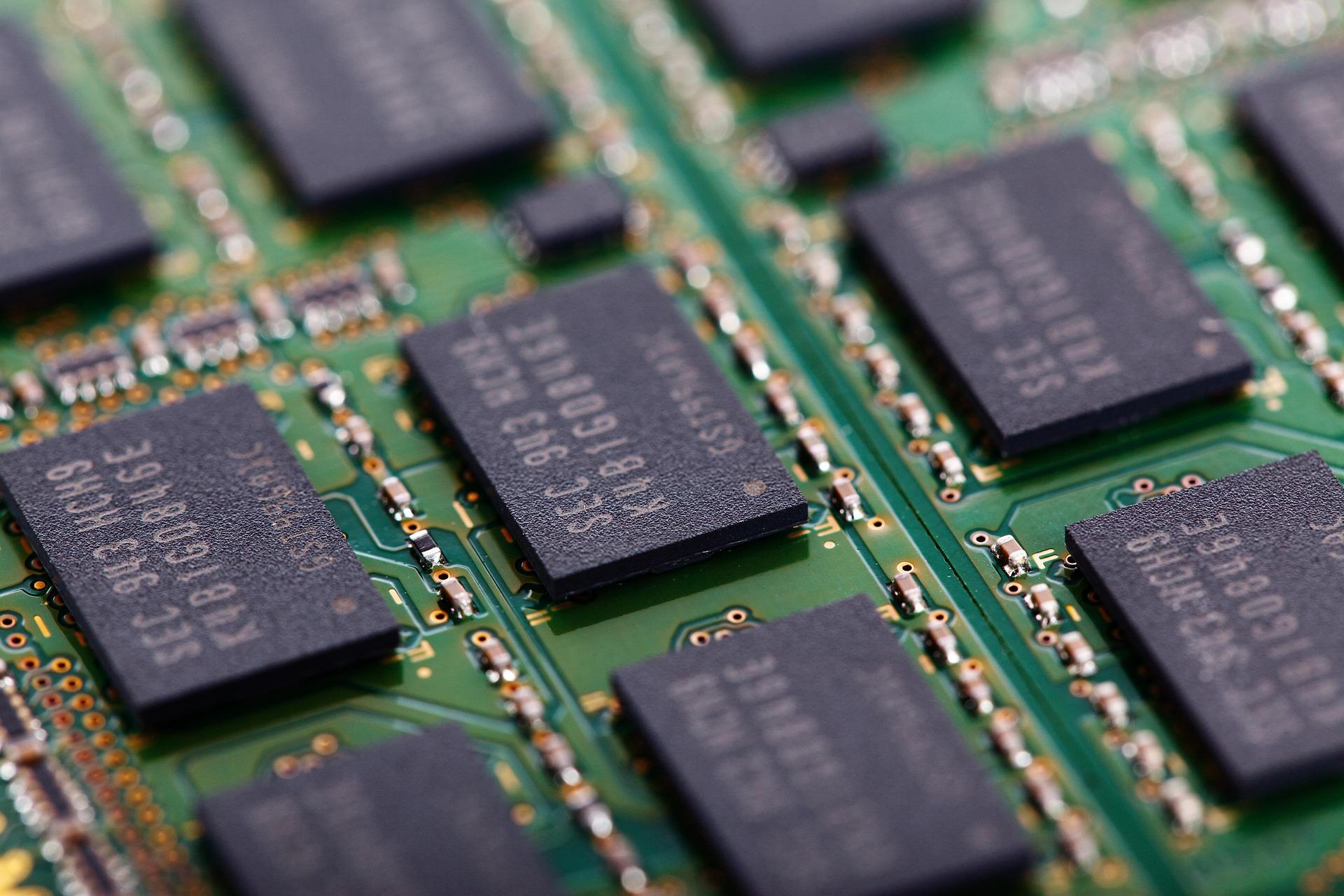

By component in 2030:

Processing: $33B

Memory: $20B

Connectivity: $14B

Power, Sensors, Logistics & Others: $10B combined

Global Semiconductor Industry Outlook

The global semiconductor industry has doubled in size over the last decade, reaching $600 billion in 2024, and is projected to cross $1 trillion by 2030, growing at 8% CAGR. Key growth drivers include AI, automation, 5G, and IoT adoption.

India’s Roadmap to $300 Billion Electronics Production by 2026

Major contributors to this growth target include:

Mobile Phones: $110B (up from $44B in 2023)

Automotive Electronics: $23B

IT Hardware: $24B

Consumer Electronics: $23B

Industrial Electronics: $25B

Hearables/Wearables: $8B

Telecom Equipment: $12B

Supply Chain Risks and India’s Strategic Advantage

With 85% of foundry capacity located in East Asia and Taiwan producing 80% of advanced chips, global supply chains face high concentration risks. TSMC dominates advanced chip manufacturing, the US leads in chip design, and ASML of the Netherlands has a monopoly on EUV lithography machines.

India offers a stable, democratic alternative for diversifying global supply chains and reducing overreliance on a few geographies.

Tackling the $60 Billion Import Dependence

India’s $60 billion net import of electronics in FY24—almost two-thirds the value of its oil imports—poses significant economic and currency risks. Localization of semiconductor manufacturing is becoming an economic necessity to mitigate external shocks.

Policy Support – India Semiconductor Mission (ISM)

Launched in December 2021 with a $10 billion corpus, ISM aims to promote:

Fabrication units (fabs)

ATMP/OSAT facilities (assembly, testing, marking, packaging)

Compound semiconductors

Display fabs

Design-linked incentives

The government offers 50% capital support for eligible projects, with states like Gujarat and Assam adding another 20%, covering up to 70% of total project cost.

Design-Linked Incentive (DLI) Scheme

This scheme offers:

50% reimbursement of eligible R&D expenditure (up to $2 million)

4–6% incentive on annual sales for five years (up to $4 million)

Currently, 13 of 25 approved design startups are scaling up. India boasts over 300,000 chip design engineers—nearly 20% of the global design talent pool.

India’s Semiconductor Success Stories

Dholera, Gujarat: India’s first semiconductor foundry, $11B investment, 50,000 wafers/month capacity for 28nm high-performance compute chips, first rollout expected by 2026.

Morigaon, Assam: Large-scale ATMP facility, $3B investment, 48M units/day for automotive, consumer, and telecom sectors.

Sanand, Gujarat:

Packaging partnerships worth $950M producing 15M units/day.

Memory ATMP ecosystem worth $2.75B focusing on DRAM and NAND flash assembly.

R&D and Skills Development

Over $800M committed to R&D, including:

$400M collaborative engineering centre in Karnataka.

Virtual nanofabrication setup to train 60,000 semiconductor engineers.

New fabless design centres from global companies.

International Partnerships

India–US iCET Initiative: Joint work on chip design, manufacturing, fab ecosystem, and STEM skill development.

India–South Korea–US Trilateral: Semiconductor supply chain collaboration.

MoUs with Japan and Thailand for equipment, materials, and packaging.

India in the Global Value Chain

India is currently strong in fabless design, growing in assembly/packaging, but still developing its front-end manufacturing capabilities. The long-term roadmap includes moving from design to OSAT, then fabs, and finally into equipment and materials manufacturing.

India-Focused Companies Leading the Charge

Moschip Technologies – Custom chip design, design IP investments.

Tata Elxsi – Chip design for EVs and AI applications.

ASM Technologies – Expanding engineering services for semiconductors.

Dixon Technologies – Scaling electronics manufacturing services and chip packaging.

Kaynes Technology – OSAT/ATMP unit in Gujarat worth $0.4B.

Syrma SGS – Component manufacturing and ATMP expansion.

CG Power – $0.9B OSAT facility in Gujarat with Renesas partnership.

Gujarat Fluorochemicals – Specialty materials for fabs.

Deepak Fertilisers – Semiconductor-grade gas manufacturing.

Sahasra Electronic Solutions – 54% stake in Sahasra Semiconductor Pvt. Ltd. for chip and memory products.

Strategic Vision – From Mobile to Microchips

India’s semiconductor market is set to reach $109 billion by 2030. With multiple mega-projects underway, robust incentives, and strong policy clarity, analysts believe India can replicate its mobile and auto manufacturing success in the semiconductor sector. The execution challenges are significant, but the vision is clear—India is not just assembling the future, it’s building it, chip by chip

Disclaimer:

This article is for informational purposes only and is based on publicly available data, government announcements, and industry analysis. It should not be construed as investment advice or a guarantee of future outcomes. Readers are advised to verify facts independently before making any business or investment decisions.