I am Niranjan Ghatule, a B.Tech graduate in Electrical Engineering with a strong passion for the financial markets. With over 5 years of hands-on experience in the stock market, I have developed deep expertise in equity research, market analysis, and trading strategies.

Posts by Niranjan Ghatule:

Trump and Putin held a historic summit in Alaska on August 15, 2025, to discuss a Ukraine ceasefire. Despite high expectations, no deal was reached, leaving global leaders and analysts divided on the outcome.

India has become Russia’s second-largest oil buyer after China, importing nearly 40% of its crude from Moscow despite Western sanctions. This surge began after the 2022 Ukraine war, when Russia offered steep discounts. With a high-stakes Trump-Putin meeting in Alaska underway, U.S. pressure on India could intensify, threatening its energy security, trade ties, and fuel prices.

Ahead of Diwali, the Modi government is set to announce major GST reforms, cutting the 12% slab to 5% on 99% goods, reducing most 28% items to 18%, and introducing a special 40% rate for tobacco products.

Donald Trump claims U.S. tariffs on India pressured Russian President Vladimir Putin into agreeing to Alaska talks on ending the Russia–Ukraine war. Meeting outcome could shape future peace or conflict.

NSDL IPO saw a sharp rise from ₹800 to ₹1,300, pushing its P/E ratio to 75. This detailed analysis compares NSDL with CDSL, explores assets under custody, revenue models, FPI preference, profit growth, and whether current valuations are justified.

Prime Minister Narendra Modi, in a historic Red Fort speech, announced the launch of India’s “Sudarshan Chakra Mission” — a next-generation indigenous weapon system inspired by Lord Krishna, aimed at making the nation’s borders impenetrable and boosting defence exports by 2035.

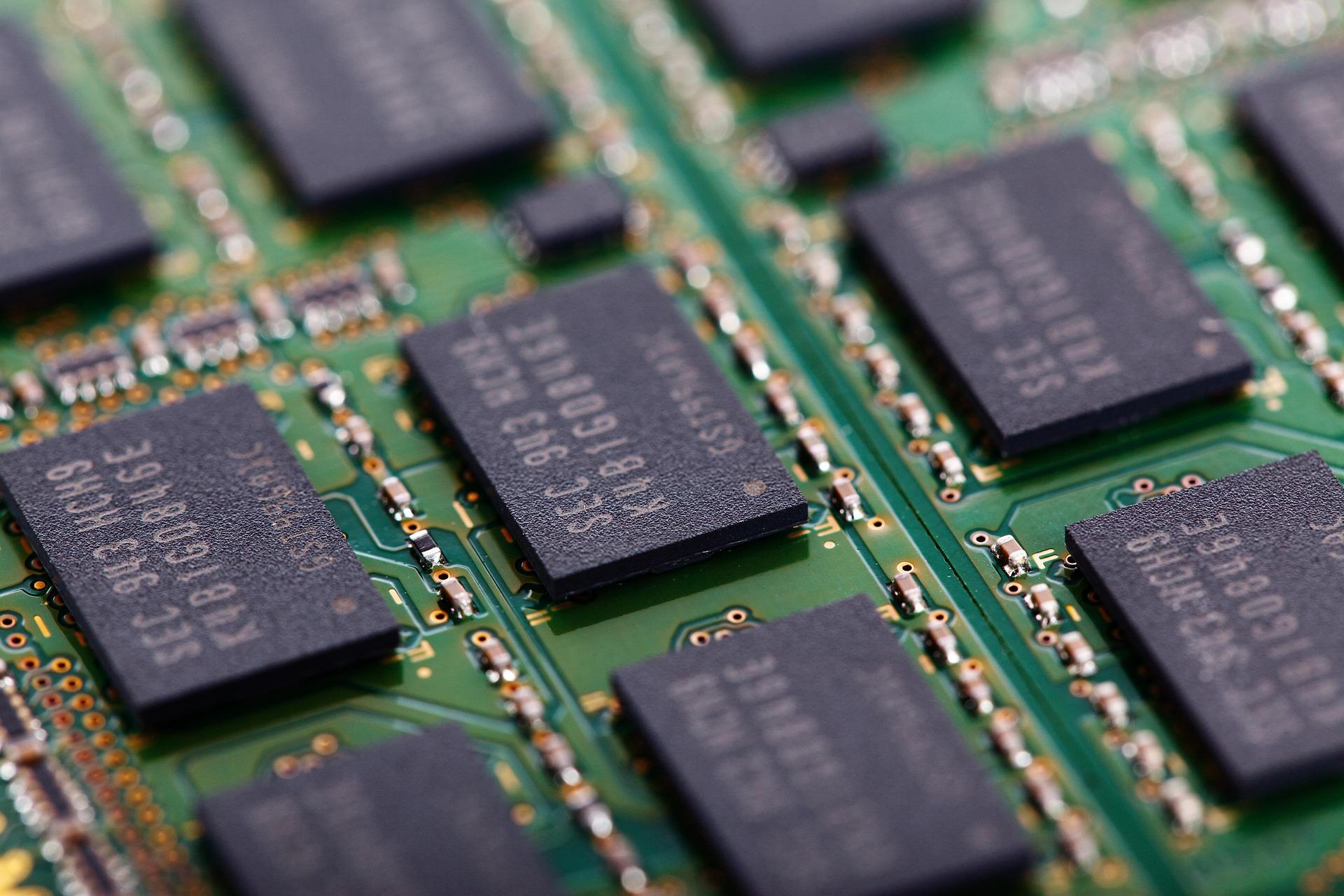

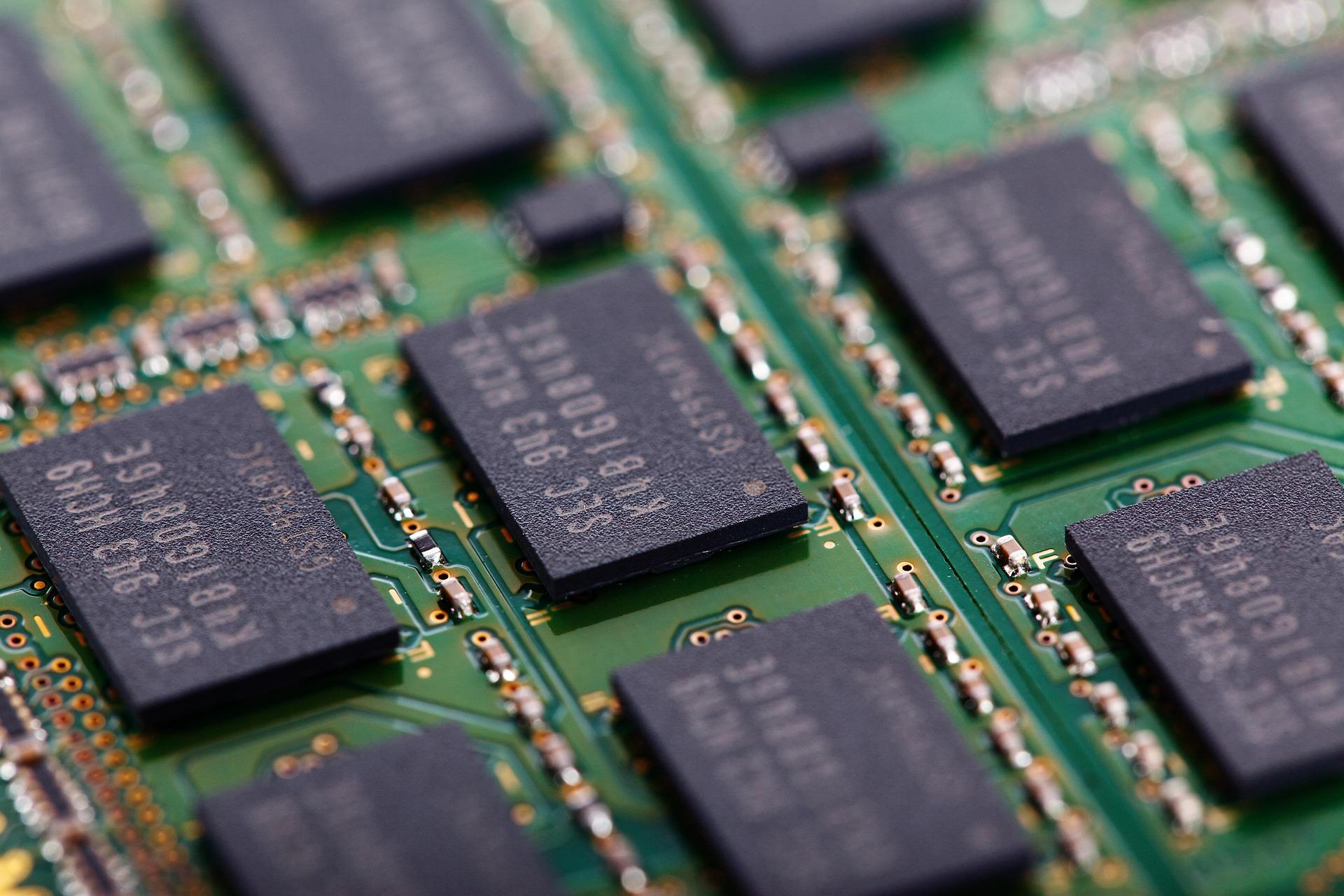

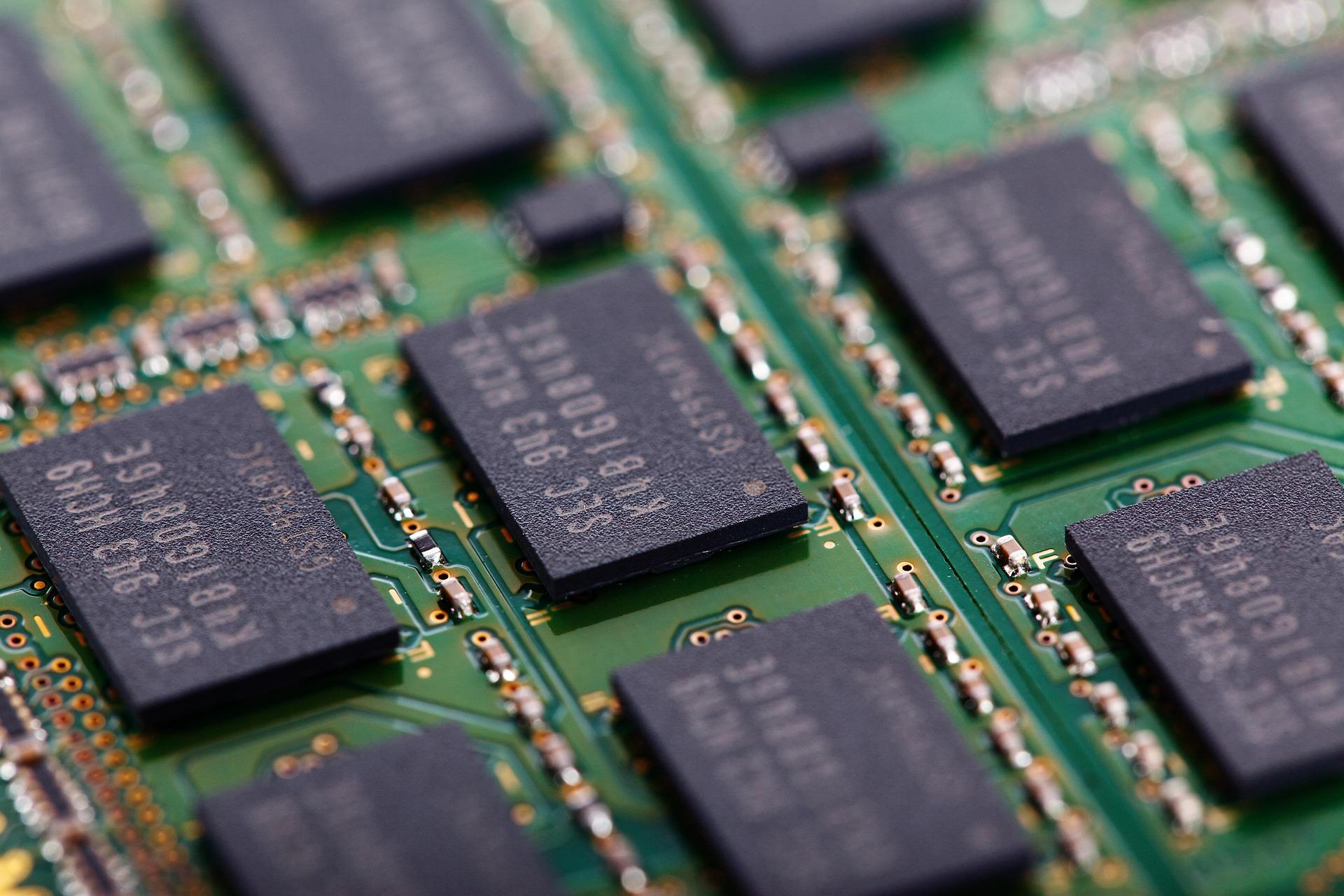

India has approved ₹4,600 crore for four new semiconductor projects in Odisha, Punjab, and Andhra Pradesh, marking a major push towards building a globally competitive chip manufacturing ecosystem. Backed by the India Semiconductor Mission, the ESDM industry is projected to grow from $102 billion in FY23 to $300 billion by FY26,

A historic Alaska meeting between US President Donald Trump and Russian President Vladimir Putin is just hours away, with hopes of ending the three-year-long Russia-Ukraine war. Trump has issued a stern warning to Putin, hinting at new sanctions if the war does not stop.

China has eased its urea export restrictions on India after years of trade curbs, allowing around 300,000 tonnes to be shipped. This move comes amid strained India-US ties and ahead of a possible visit by PM Modi to China. The development could provide relief to Indian farmers, help stabilize global supply chains, and signal a shift in Asian geopolitical equations.

Suzlon Energy shares have seen sharp volatility after hitting record highs, with concerns over the CFO’s resignation and EPC mix decline weighing on sentiment. However, strong Q1 results, a robust 5.7 GW order book, and favorable government policies continue to support the company’s long-term growth prospects.

The United States has launched an anti-dumping investigation against Indian solar companies following complaints from American manufacturers. The probe, targeting firms from India, Indonesia, and Laos, alleges that Indian exporters, especially Waaree Energies, are selling solar products up to 123% cheaper than production cost and benefiting from subsidies.

India has approved two major projects – the ₹8,146 crore Tato-II hydropower project in Arunachal Pradesh’s Shi-Yomi district and four new semiconductor manufacturing units in Odisha, Punjab, and Andhra Pradesh worth ₹4,594 crore.